Table of Content

Our free Home Mortgage Calculator for Excel is a powerful all-in-one worksheet that combines many of the features from our other mortgage and loan calculators. It lets you analyze a variable-rate mortgage or fixed-rate mortgage, and figure out how much you can save by making extra payments. The following table shows locally available mortgage rates which you can use to help calculate your monthly home loan payments. PMT function is used to calculate the monthly payments made towards the repayment of a loan or mortgage. The first is to enter the original loan amount and date and then make adjustments to the payment history within the Payment Schedule as needed.

Other common domestic loan periods include 10, 15 & 20 years. Some foreign countries like Canada or the United Kingdom have loans which amortize over 25, 35 or even 40 years. A home loan is probably the biggest loan you will ever take in your life. At least for the vast majority of people who aren’t into business requiring business loans. So you should understand how to calculate EMI on home loan correctly even if you have to use a loan EMI calculator in excel or otherwise. Be careful in adjusting the interest rate as per monthly basis and loan time period from years to no. of months .

Mortgage Calculator Excel Templates to Help You Save Money

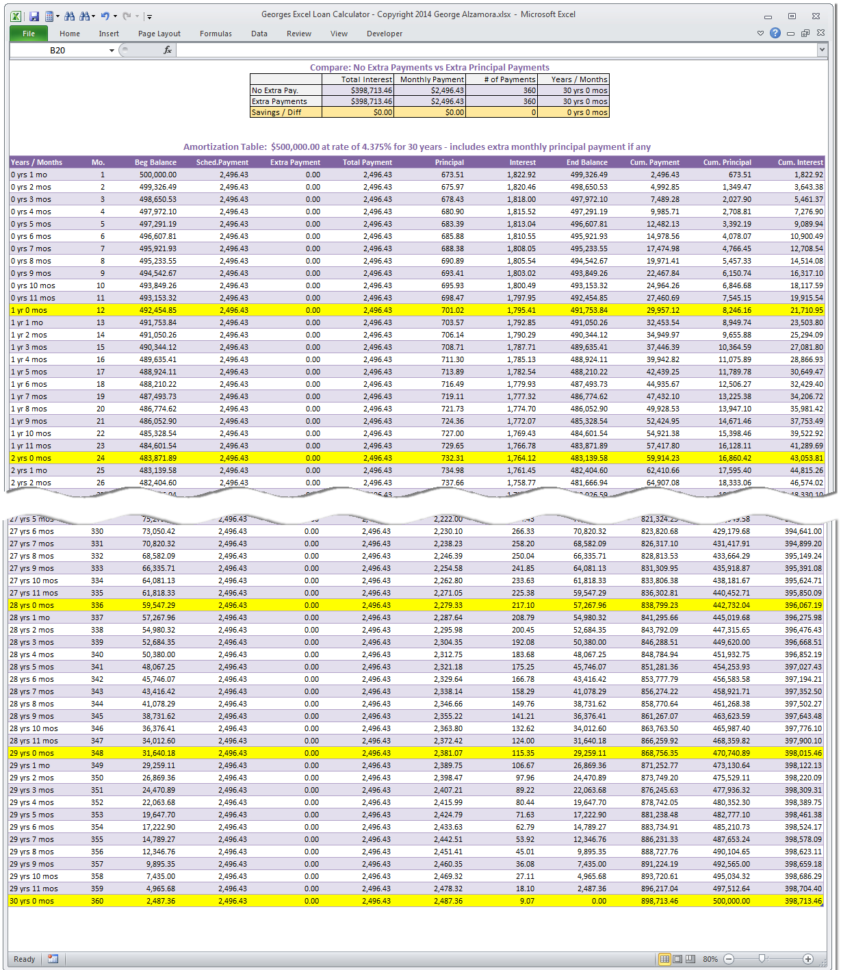

It also calculates the outstanding balance at the end of a specified number of years and the tax returned if the interest paid is tax deductible. Generate a loan amortization schedule based on the details you specify with this handy, accessible loan calculator template. The LoanCalculator worksheet is very similar to our home mortgage calculator. That is because a home equity loan is just a second standard fixed-rate mortgage, as opposed to a HELOC or Home Equity Line Of Credit which is a different thing altogether.

The lender, usually Banks or other financial institutions, takes three elements and use them in a formula to calculate the monthly payment. The terms are often used interchangeably, and almost any mortgage calculator can be used for a home equity loan. This calculator evaluates a fixed-rate loan, with optional extra payments (which you set up to simulate accelerated bi-weekly payments). If you need an adjustable rate mortgage calculator, you can try the ARM mortgage calculator. If you are looking for a home equity line of credit calculator, try our HELOC calculator.

Home Loan EMI Calculator Amortization Schedule (Free Excel Download

As you see here, the interest rate is in cell B2 and we divide that by 12 to obtain the monthly interest. Then, the number of payments is in cell B3 and loan amount in cell B4. Also, read why taking personal loan for downpayment is not advisable. WPS Office excels in providing high-quality financial templates that are both easy to use and understand. We have a wide range of options available, so you can pick the one that's right for you.

Get the annual interest rate, number of payments you’d like, and total loan amount and enter these into your sheet. Select the cell where you want to calculate the monthly payment; this is where you’ll insert the PMT function. These are just a few of the mortgage calculator excel templates that you can use to save money on your next home purchase! Be sure to shop around and compare mortgage rates before you make your final decision.

New Features of our Home Mortgage Calculator

And in the later years of the loan tenure, the EMIs contribute more towards repayment of the loan principal. The HomeEquity worksheet lets you calculate the amount of equity in your home after a number of years. To obtain a commercial use license, purchase the Vertex42 Loan Amortization Schedule.

Loan start date - the date which loan repayments began, typically a month to the day after the loan was originated. Home Mortgage Calculator at Bankrate.com - For an online mortgage calculator, this is a pretty good one. The syntax for the function is NPER where the first three arguments are required for rate, payment, and loan amount. The Federal Reserve has started to taper their bond buying program. For your convenience, we publish local Los Angeles mortgage rates below to help you see currently available rates. Many people are looking to maximize the tax benefits of home loans.

It creates an amortization schedule and allows you to either set up periodic extra payments, or manually enter prepayments in the payment schedule. It doesn't matter whether you've made prepayments in the past, you just enter the current balance, the annual interest rate, and your monthly payment . Unlike other home equity loan calculators, this one lets you include your 1st mortgage and your 2nd mortgage . Loan calculator excel is used to calculate the monthly loan payments. Get a printable loan amortization schedule that is exportable into excel or text files. This Excel spreadsheet is an all-in-one home mortgage calculator.

Now, we will see how to use the PMT function to calculate the monthly payment. Maybe you have an existing loan and want to quickly see the annual interest rate you’re paying. As simple as calculating a payment with basic loan details, you can do the same to determine the interest rate.

You just need to provide inputs like the loan amount, loan tenure and interest rate. And this continues for one by one for all the months in the loan tenure. Open and create multiple documents in new tabs of the same window, rather than in new windows. Once you change a value, the result gets automatically updated.

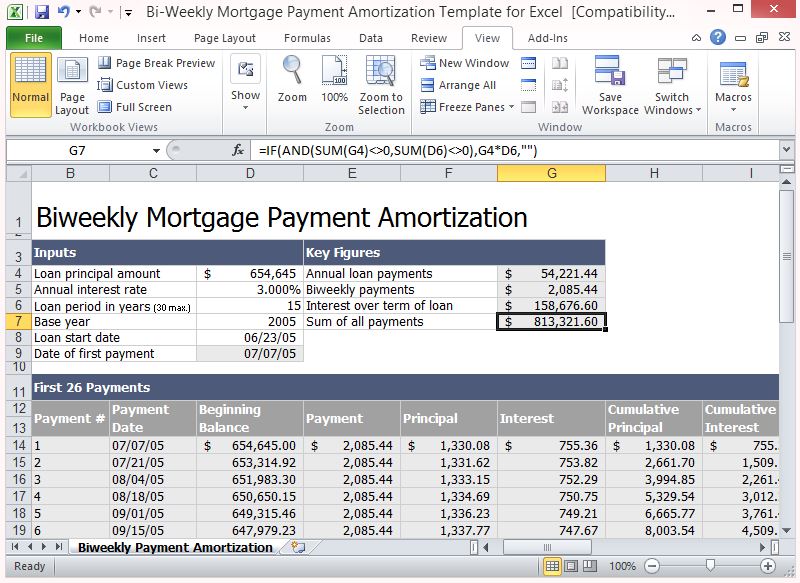

Usually, the bi-weekly payment amount is half of the normal monthly payment, which means that you are also paying extra principal, because you make 26 payments per year. In the home equity loan calculator spreadsheet, you can simulate this by making an extra payment of Payment/12 each month, where Payment is the normal monthly payment. The calculations will be very close to reality, as long as your lender doesn't charge you fees for making prepayments. But, the amortization table probably won't match exactly what your lender provides. This Excel workbook is a feature-packed spreadsheet that lets you calculate your monthly payment on a fixed-rate home equity loan.

For this purpose, we have two other functions, which are PPMT and IPMT. With the help of Excel, you can create a spreadsheet and calculate the monthly payments for yourself. These elements are used in formulas to calculate the monthly payments for the repayment of your loan.

No comments:

Post a Comment